Leading Tips for Efficiently Handling Funds With an Invoice Book in Your Company

Efficient monetary management is necessary for any type of business, and an invoice publication plays a substantial duty in this procedure. It offers as a vital device for tracking earnings and expenditures while making sure prompt repayments. Picking the suitable invoice publication and arranging billings effectively are fundamental actions. However, there are extra approaches to enhance overall effectiveness. Recognizing these approaches can considerably influence a business's monetary security and development possibility. What are the most effective practices to contemplate?

Understanding the Importance of an Invoice Book

An invoice book offers as a critical device for organizations looking for to preserve organized economic documents. It enables companies to record deals methodically, making sure that all sales and solutions made are precisely taped. This methodical paperwork is vital for tracking income, keeping an eye on capital, and taking care of expenses.Moreover, a billing book aids in keeping professionalism and reliability in company transactions. Offering customers with thorough billings enhances integrity and trust fund, promoting more powerful customer relationships. Additionally, it streamlines the procedure of declaring taxes, as all required economic info is easily available and organized.

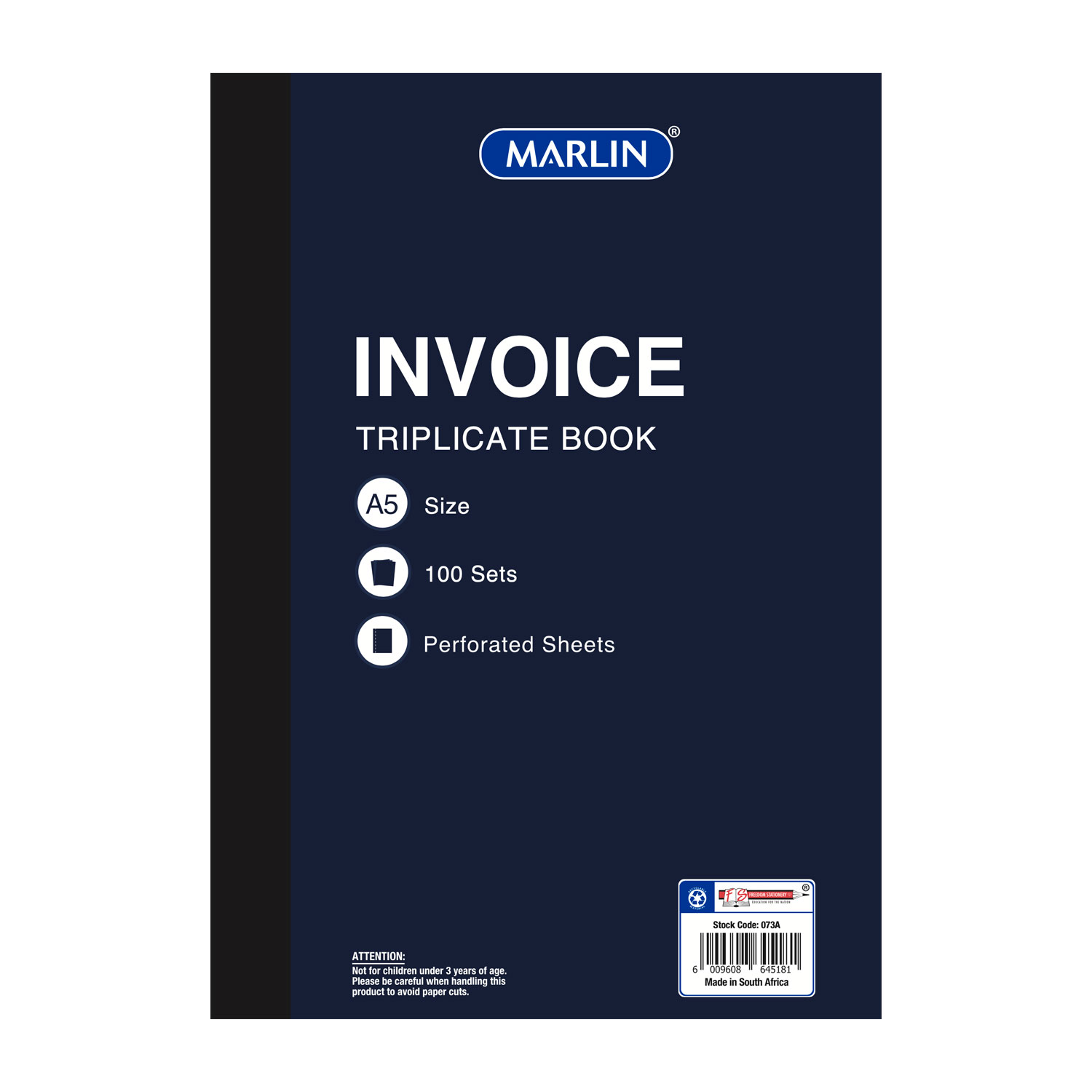

Selecting the Right invoice book for Your Company

Choosing the suitable billing book is important for organizations wanting to streamline their financial monitoring. The option usually rests on numerous essential variables, including the nature of business, the volume of transactions, and certain invoicing requirements. As an example, local business with fewer purchases might gain from a simple, pre-printed invoice book, while bigger ventures may require personalized alternatives that permit comprehensive itemization and branding.Additionally, companies ought to think about whether they favor a physical or digital layout. Digital invoice publications can use boosted attributes like automated estimations and very easy information storage space, while physical publications give a substantial document. It is likewise important to examine guide's design for clarity and convenience of use. Inevitably, the appropriate invoice book will not just help with efficient invoicing but also add to better cash money flow monitoring and enhanced consumer relationships.

Organizing Your Invoice for Easy Access

Organizing invoices effectively is important for any kind of organization, as it assures fast accessibility to crucial monetary documents when required. A methodical method can enhance performance and decrease stress throughout audits or monetary analyses. It is suggested to classify invoices by kind, client, or day, enabling straightforward access. Utilizing color-coded folders or labeled areas within an invoice publication can promote this process, making certain that papers are conveniently recognizable at a glance.Moreover, maintaining a digital back-up of physical billings can provide an extra layer of safety and security and access. Regularly examining and purging out-of-date billings will assist keep the system workable, preventing clutter. Developing a routine for organizing and storing billings, whether day-to-day or weekly, can substantially streamline monetary procedures. By prioritizing organization, businesses can save time, lower errors, and support much better economic decision-making, ultimately resulting in boosted overall monitoring of finances.

Monitoring Settlements and Due Dates

Monitoring repayments and due dates is essential for preserving financial security. Organizing payment timetables can help individuals manage their cash money circulation efficiently while lessening late fees. Furthermore, establishing suggestion alerts guarantees that no payment due dates are ignored.

Arrange Settlement Schedules

Establishing a clear payment schedule is important for maintaining economic security and guaranteeing timely capital. Companies can take advantage of organizing repayment schedules by classifying billings according to their due dates. This approach enables for easy recognition of upcoming settlements, allowing proactive monitoring of money resources. By segmenting billings right into regular or monthly timelines, organizations can concentrate on critical repayments while additionally examining patterns in money inflow. Furthermore, a structured schedule help in forecasting future monetary requirements, which is considerable for budgeting objectives. Constantly evaluating and updating settlement routines guarantees that no due dates are missed, cultivating solid relationships with customers and suppliers. Ultimately, a reliable settlement timetable enhances total monetary administration and sustains a company's development purposes.

Establish Tip Alerts

Just how can companies guarantee they never ever miss out on a payment target date? One effective technique involves establishing tip signals. By carrying out automated pointers, companies can assure timely alerts for upcoming payments and due days. invoice book. This can be achieved through numerous methods, such as calendar applications, invoicing software, or devoted reminder apps.These notifies can be set up to notify customers days or perhaps weeks ahead of time, allowing sufficient time for prep work. Additionally, companies need to consider categorizing suggestions based on priority, ensuring that critical payments get unique interest. By constantly making use of suggestion signals, companies can boost their cash money circulation management and keep favorable relationships with clients and suppliers. Inevitably, this aggressive technique minimizes the risk of late fees and promotes monetary stability

Implementing Consistent Billing Practices

Although many businesses identify the significance of timely settlements, implementing regular invoicing methods typically shows challenging. Developing a standardized invoicing procedure can substantially improve capital administration. This consists of setting specific periods for issuing billings, whether regular, bi-weekly, or monthly, depending upon the nature of the business and customer relationships.Furthermore, companies need to ensure that billings are clear and in-depth, laying out solutions rendered, settlement terms, and due dates. Making use of a methodical approach to act on impressive billings is equally crucial; tips can be automated to maintain expertise and consistency.Additionally, training personnel on the payment procedure can foster liability and precision, lowering errors that might postpone settlements. Frequently assessing and adjusting billing practices can help companies remain straightened with industry standards and customer expectations, eventually promoting a healthier financial environment. Consistency in these practices not only enhances efficiency however additionally builds trust with clients.

Utilizing Invoice Templates for Efficiency

Utilizing invoice design templates can considerably boost the efficiency of the invoice creation process. By streamlining this task, businesses can save time and reduce mistakes, enabling quicker settlement cycles. In addition, tailoring layouts for branding objectives warranties that billings show the firm's identification, strengthening professionalism and trust in customer communications.

Improving Invoice Creation Process

Enhancing the invoice development process can significantly enhance a business's performance and precision. invoice book. By making use of pre-designed invoice layouts, businesses can decrease time invested in composing billings from scrape. These templates typically consist of essential areas, such as client details, made a list of solutions, and repayment terms, making certain that all needed details are captured consistently.Furthermore, using invoice software can automate computations and lower the chance of human error. This not just accelerates the process yet also boosts record-keeping by preserving an electronic archive of all invoices provided. In addition, standardized layouts can assist in quicker reviews and authorizations within business, making it possible for timely invoicing and boosting capital. On the whole, an efficient billing production process is crucial for keeping financial health in an affordable market

Tailoring Design Templates for Branding

Tailoring billing templates for branding can considerably improve a business's expert picture while making certain efficiency in the billing procedure. By incorporating company logo designs, color design, and typography that reflect the brand identity, companies create a cohesive look that fosters trust and recognition amongst clients. Tailored themes can additionally streamline data entry by integrating pre-filled fields for client information and services offered, lowering mistakes and conserving time. In addition, including customized messages or terms of solution can reinforce customer relationships. Businesses ought to consistently assess and upgrade their billing designs to straighten with any kind of branding changes, making certain that their payment procedure continues to be an expansion of their brand name. This critical strategy not just boosts performance yet additionally enhances the brand name's existence in the marketplace.

Frequently Examining Your Financial Health

Regularly Asked Concerns

Just how Often Should I Update My invoice book?

The regularity of upgrading an invoice book differs by company demands. Typically, it is recommended to update it consistently, ideally after each transaction, to preserve exact records and assist in reliable economic administration.

Can I Utilize Digital Invoices As Opposed To a Physical Publication?

The question of utilizing electronic billings as opposed to a physical book shows a shift in the direction of modern financial administration - invoice book. Digital billings offer comfort and access, enabling organizations to simplify processes, reduce paper waste, and enhance record-keeping performance

What Should I Do if a Billing Is Lost?

If a billing is lost, the person ought to promptly alert the customer, edition a duplicate billing, and document the situation for record-keeping. Preserving a clear communication trail can stop prospective misconceptions or disagreements.

How Do I Take Care Of Late Repayments Properly?

Dealing with late settlements efficiently involves sending out polite pointers, establishing clear settlement terms in advance, and preserving open interaction with customers. Applying a structured follow-up process can greatly decrease delays and boost cash flow for business.

Is It Required to Maintain Copies of Expired Invoices?

The need of keeping copies of run out billings differs by industry and lawful needs. Some services preserve them for referral, audits, or tax purposes, while others may discard them, depending upon their functional requirements and policies.

Comments on “Why a carbonless invoice book can streamline your paperwork and reduce mess”